Bitcoin recently made a significant breakthrough, with its price surpassing the iconic $50,000 mark. The rally was driven by expectations of an impending interest rate cut and the recent approval of Bitcoin spot ETFs. The upcoming halving gives investors more momentum at this time. But are we really facing a big rally right now?

Short sellers get liquidated and more investors take profits

Over the past 24 hours, the overall cryptocurrency market has registered an increase of more than 4 percent, reaching a market capitalization of around $1.87 trillion. This market capitalization is expected to cross the $2 trillion mark soon. What is remarkable now is that Bitcoin trading volume has suddenly increased by 100 percent to $40 billion.

According to data from Coinglass, more than 53,000 traders liquidated in the last 24 hours, with the total liquidation of long and short positions amounting to approximately $173 million. The largest single liquidation was $3.14 million and affected the LINK/USD pair on Bitmex. Notably, Bitcoin alone saw about $65 million worth of liquidations, of which $52 million were short positions.

According to IntoTheBlock, 93 percent of investors are in profit, which represents unrealized gains on their Bitcoin holdings. Now that many investors want to take a profit, such a rate increases the risk of a drag.

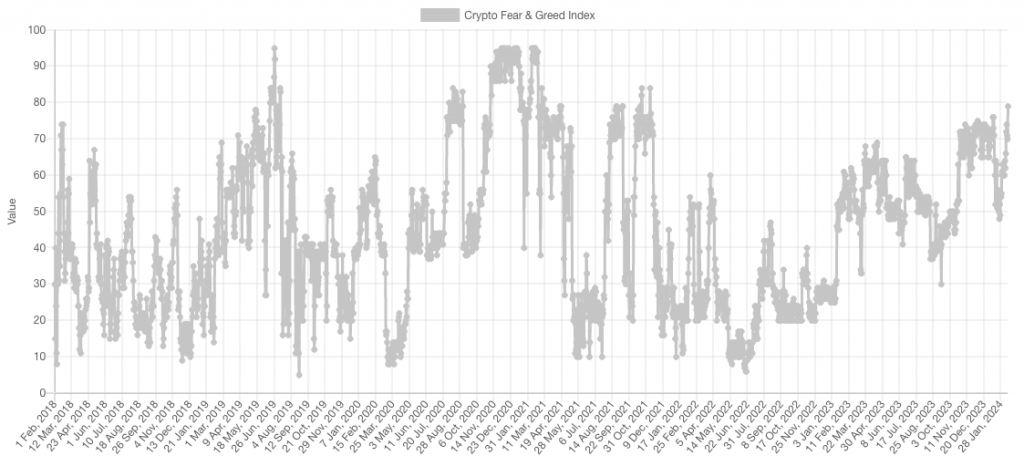

The fear and greed index is at its peak again

Recent data from the Fear and Greed index demonstrates the positive sentiment surrounding Bitcoin. It reached a value of 79 on February 13. This marks the highest level since Bitcoin hit an all-time high in mid-November 2021, when the leading cryptocurrency hit an all-time high of $69,000.

The index's recent rise in the “highly greedy” category follows Bitcoin's break above $50,000. Not only is this latest jump in the index into the “highly greedy” zone, but the index value already reached 76 on January 11th. The peak at the time was a growing focus on the launch of spot bitcoin exchange-traded funds (ETFs) in the United States.

Such a high value in the fear and greed index raises voices among analysts to be cautious in the current market situation. Although many investors are currently bullish and most of them are in profit, historically speaking, you can expect sharp pullbacks and corrections precisely at these market phases.

This is how the Bitcoin price can evolve

For the first time in more than two years, Bitcoin has crossed the $50,000 mark. The rally has fueled a 15 percent increase in the cryptocurrency's value this year. In particular, the approval of spot bitcoin ETFs in January and the prospect of a bitcoin halving led to significant capital inflows.

Bitcoin is currently hovering around the psychologically most relevant price level of $50,000 and facing immediate resistance levels of $50,300 and $51,200. In the event of a correction, support zones at $49,500 and $48,750 provide support. The Relative Strength Index is at 77, indicating a possible overbought position.

Given the strong resistance at $50,000, the coming days will show whether Bitcoin can establish a level of support. The price has now dipped back down slightly to $49,900. If Bitcoin wins the bullish scenario, a new all-time high before the next halving in April is more realistic.

While Bitcoin is currently showing an impressive rally, there is an alternative investment opportunity on the horizon that promises even higher returns: Meme Kombat ($MK).

This new memecoin could soon generate more income than Bitcoin

Meme Kombat offers a unique combination of entertainment and investment opportunity. Unlike Bitcoin, whose value is primarily driven by its function as digital gold, its value is Combat Memes Its functions as a gaming platform and explosive memecoin.

The platform allows users to actively participate in the ecosystem through various activities including meme contests and interactive games. Additionally, it offers its users the opportunity to profitably share their $MK coins. You can currently earn more than 110 percent per year. Investors can still get discounts Presale Investment. One $MK costs just $0.279 and has already attracted $8.7 million in funding.

Every trade is risky. Success is not guaranteed. All content on our website is for informational purposes only and does not constitute a purchase or sale recommendation. It also applies to assets and products, services or other investments. Opinions expressed on this site do not constitute investment advice and independent financial advice should be obtained whenever possible. This site is free to use, but we may receive commissions from the companies we feature on this site.